Key Differences Between Federal, State, and Local Programs for Green Home Improvement

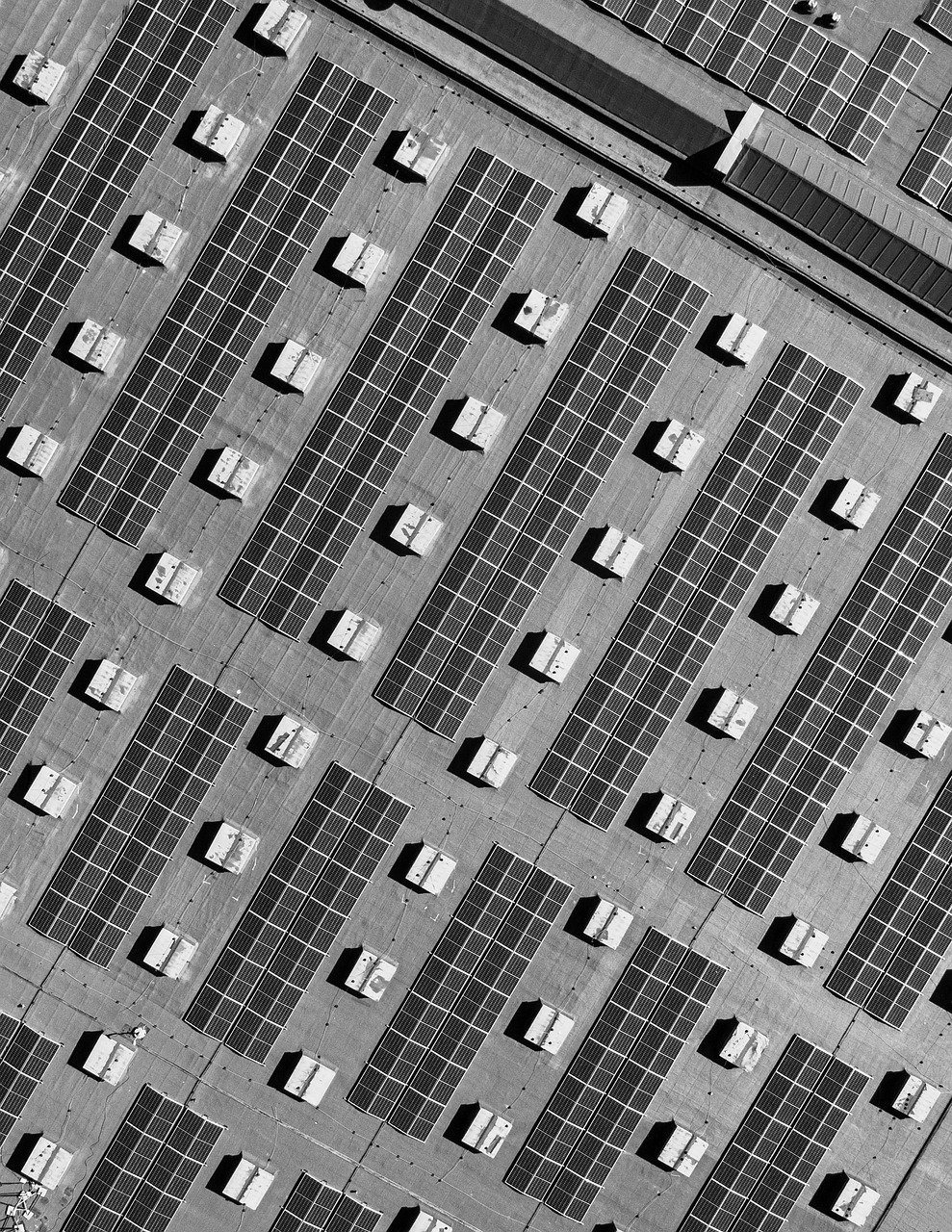

When navigating the world of loans for solar panels and green home improvement loans, it’s crucial to understand the distinctions between federal, state, and local programs. Each level of government offers unique benefits and requirements, impacting how you finance eco-friendly upgrades for your home. This article explores these differences in detail, helping you make informed decisions about which program best suits your needs.

Federal Programs for Green Home Improvement Loans

1. Overview of Federal Programs

Federal programs play a pivotal role in promoting energy efficiency across the country. They offer comprehensive solutions for homeowners seeking green home improvement loans. For instance, the Federal Housing Administration (FHA) provides the FHA Energy Efficient Mortgage (EEM) program, which allows borrowers to finance energy-efficient upgrades as part of their mortgage. This program is designed to make it easier for homeowners to invest in energy-saving technologies.

According to Energy.gov, federal programs often feature lower interest rates and longer repayment terms compared to other financing options. They are a solid choice for homeowners who want to make significant green improvements without incurring high upfront costs.

2. Benefits of Federal Programs

Federal programs offer numerous benefits, including:

- Low-interest rates: These programs often provide competitive interest rates, making green home improvements more affordable.

- Extended repayment terms: Homeowners can spread the cost of their improvements over a longer period, reducing monthly payments.

- Incentives and rebates: Some federal programs include additional incentives or rebates for energy-efficient upgrades.

For example, the Department of Energy outlines several federal incentives available to homeowners investing in solar panels and other energy-saving technologies.

3. Application Process for Federal Programs

The application process for federal programs can be complex. Typically, it involves several steps:

- Determine eligibility: Homeowners must ensure they meet the program’s eligibility criteria.

- Prepare documentation: Gather necessary documents, including proof of income and property details.

- Submit an application: Complete and submit the application to the appropriate federal agency or lender.

It’s essential to carefully review the requirements and deadlines to avoid delays or complications in securing funding.

State Programs for Loans for Solar Panels

1. Overview of State Programs

State programs provide tailored solutions for loans for solar panels and other green home improvements. Unlike federal programs, state initiatives often address regional needs and priorities. For instance, California’s California Solar Initiative (CSI) offers rebates and incentives specifically for solar panel installations.

State programs can vary significantly, with each state designing its initiatives to promote sustainability and energy efficiency. For detailed information about state-specific programs, refer to DSIRE, a comprehensive resource for renewable energy and energy efficiency incentives.

2. Benefits of State Programs

State programs offer several advantages, including:

- Localized incentives: Tailored to meet the specific needs and priorities of the state.

- Additional rebates: Many state programs provide rebates or additional incentives beyond federal offerings.

- Support for local businesses: Some programs prioritize using local contractors and suppliers.

For example, the California Public Utilities Commission provides a variety of incentives for solar panel installations and energy-efficient home improvements.

3. Application Process for State Programs

Applying for state programs typically involves the following steps:

- Research available programs: Use resources like DSIRE to identify applicable programs in your state.

- Verify eligibility: Ensure you meet the program’s requirements.

- Submit application: Follow the specific application procedures outlined by the state program.

Each state program has its own set of requirements and application procedures, so it’s important to consult with local agencies for detailed guidance.

Local Programs for Green Home Improvement Loans

1. Overview of Local Programs

Local programs, such as those offered by municipalities or utility companies, can provide targeted support for green home improvement loans. These programs often focus on specific communities or neighborhoods, offering unique benefits and incentives.

For instance, some cities have their own loan programs or grant opportunities to support energy-efficient home improvements. Local programs can be particularly advantageous for residents looking to make improvements within their specific community.

2. Benefits of Local Programs

Local programs often provide:

- Community-specific benefits: Incentives and support tailored to local needs and conditions.

- Easier access to funding: Programs may offer streamlined application processes for residents.

- Support for local projects: Emphasis on community-based projects and improvements.

For example, GreenBiz highlights various local initiatives aimed at promoting sustainability and energy efficiency.

3. Application Process for Local Programs

The application process for local programs can vary widely. Generally, it includes:

- Identify local programs: Research available programs through city or county websites and local utility companies.

- Check eligibility: Verify that you meet the program’s criteria.

- Complete application: Follow the specific application guidelines provided by the local program.

It’s crucial to stay informed about deadlines and requirements to ensure a smooth application process.

Comparison Table: Federal vs. State vs. Local Programs

| Feature | Federal Programs | State Programs | Local Programs |

|---|---|---|---|

| Scope | Nationwide | State-specific | Community-specific |

| Incentives | Low-interest rates, extended terms | Local rebates and incentives | Community-based benefits |

| Application Process | Complex, with multiple steps | Varies by state, typically less complex | Varies widely, often streamlined |

| Eligibility Requirements | Standardized national criteria | State-specific criteria | Local criteria |

Conclusion

Understanding the key differences between federal, state, and local programs can significantly impact your decision-making process when seeking loans for solar panels or green home improvement loans. Federal programs provide broad, nationwide benefits with often lower interest rates and longer repayment terms. State programs offer more localized incentives and rebates tailored to regional needs, while local programs focus on community-specific benefits and support.

Each program type has its advantages and application processes. By evaluating these differences, you can choose the program that best aligns with your goals and financial situation.