Energy-Efficient Mortgages (EEMs)

Energy-Efficient Mortgages (EEMs) are designed to help homeowners finance energy-efficient upgrades, including solar panels and other green improvements. This guide explores what EEMs are, their benefits, how to qualify, and the different types available.

What are Energy-Efficient Mortgages (EEMs)?

Energy-efficient mortgages (EEMs) are specialized home loans that allow borrowers to finance energy-efficient home improvements as part of their mortgage. By incorporating the cost of energy-efficient upgrades into the mortgage, homeowners can achieve long-term savings on their energy bills while enhancing their property’s value.

Purpose of EEMs

EEMs are intended to make energy-efficient home improvements more accessible and affordable. Loans for solar panels and green home improvement loans are commonly included in these mortgages. This financing option enables homeowners to invest in sustainable upgrades without bearing the full upfront cost.

Types of Energy-Efficient Mortgages

EEMs come in various forms, each catering to different needs and preferences:

- FHA Energy Efficient Mortgage: Offered by the Federal Housing Administration (FHA), this loan allows borrowers to add the cost of energy-efficient upgrades to their FHA-insured mortgage.

- VA Energy Efficient Mortgage: For veterans and active-duty service members, the Department of Veterans Affairs (VA) offers a similar option to finance energy-efficient improvements.

- Conventional EEM: Conventional EEMs are available through private lenders and may have varying requirements and benefits.

Benefits of Energy-Efficient Mortgages

Opting for an EEM provides several benefits, making it a compelling choice for homeowners looking to invest in energy efficiency.

Lower Energy Bills

By investing in green home improvement loans, homeowners can significantly reduce their energy consumption and lower utility bills. Upgrades such as energy-efficient windows, insulation, and solar panels can result in substantial savings over time.

Increased Property Value

Energy-efficient upgrades can enhance the overall value of a home. Potential buyers often view energy-efficient features as a desirable attribute, which can increase resale value and attract more interest.

Environmental Impact

EEMs promote sustainability by encouraging homeowners to make environmentally friendly improvements. Reducing energy consumption lowers the carbon footprint, contributing to a healthier planet.

How to Qualify for an EEM

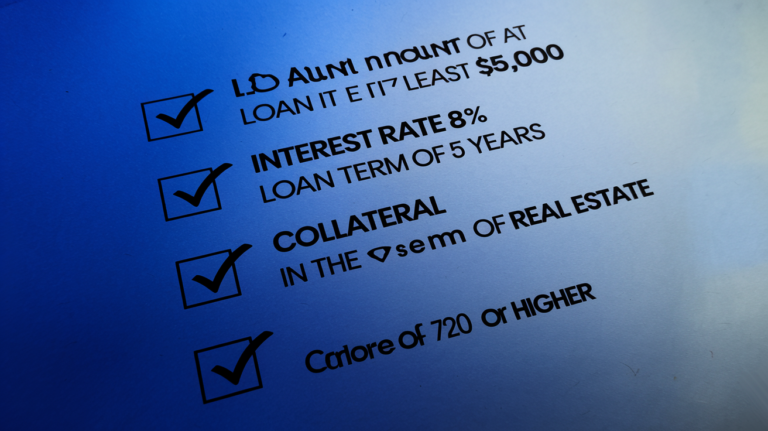

Qualifying for an Energy-Efficient Mortgage involves meeting specific requirements. Understanding these criteria is crucial for a successful application.

Credit Score and Financial Stability

Most EEM programs require a good credit score and a stable financial history. Lenders assess your creditworthiness to determine your eligibility for the mortgage.

Home Energy Assessment

A home energy assessment, or energy audit, is typically required to identify areas where energy-efficient improvements can be made. This assessment helps determine the cost and potential savings of the upgrades.

Loan-to-Value Ratio

The loan-to-value (LTV) ratio is a critical factor in qualifying for an EEM. Lenders use this ratio to evaluate the risk of the loan. A lower LTV ratio may improve your chances of approval.

Different Types of EEM Programs

Various EEM programs cater to different needs and financial situations. Here’s a closer look at some of the most common types:

FHA Energy Efficient Mortgage Program

The FHA Energy Efficient Mortgage program is designed to help homeowners finance energy-efficient improvements with a lower down payment. This program is ideal for those who already have an FHA mortgage or are looking to purchase a home with energy-efficient upgrades.

Key Features:

- Can be used for both new purchases and refinancing.

- Allows up to 5% of the property’s value for energy improvements.

- External link: FHA Energy Efficient Mortgage Program

VA Energy Efficient Mortgage Program

The VA Energy Efficient Mortgage program helps veterans and service members finance energy-efficient home improvements. This program offers benefits like no down payment and competitive interest rates.

Key Features:

- No down payment required.

- Includes financing for improvements up to 10% of the property’s value.

- External link: VA Energy Efficient Mortgage Program

Conventional EEM Program

Conventional EEMs are offered by private lenders and may have more flexible terms compared to government-backed loans. They can be used for various types of energy-efficient upgrades and may offer competitive rates.

Key Features:

- Terms and conditions vary by lender.

- Can be used for a wide range of improvements, including solar panels.

- External link: Conventional EEM Program Overview

Applying for an Energy-Efficient Mortgage

Applying for an EEM involves several steps, each crucial to securing the loan and completing your home improvements.

Preparing Your Finances

Before applying, ensure your finances are in order. This includes reviewing your credit score, gathering financial documents, and understanding your budget. Being well-prepared increases your chances of approval.

Completing the Home Energy Assessment

A professional home energy assessment will identify the most cost-effective improvements. The results will help you decide which upgrades to prioritize and provide a cost estimate for the improvements.

Choosing the Right Lender

Selecting a lender who offers EEMs and compares terms is essential. Look for lenders with experience in green home improvement loans and favorable loan conditions.

Conclusion

Energy-efficient mortgages (EEMs) offer a valuable opportunity for homeowners to finance energy-efficient upgrades. With options like the FHA and VA Energy Efficient Mortgage programs, as well as conventional EEMs, there are various ways to make green improvements more affordable. By understanding the benefits, qualification criteria, and application process, you can make informed decisions and enhance your home’s energy efficiency.