Qualifying Criteria for Green Loans

Green loans are becoming an increasingly popular option for homeowners looking to invest in energy-efficient upgrades. These loans, including loans for solar panels and green home improvement loans, offer financial assistance for projects aimed at enhancing energy efficiency and reducing environmental impact. To qualify for these loans, you must meet specific criteria. This article explores the essential qualifying criteria, ensuring you understand what it takes to secure green financing for your home improvement projects.

1. Understanding Green Loans and Their Benefits

What Are Green Loans?

Green loans are designed to finance eco-friendly home improvements. These loans can be used for various projects, such as installing solar panels, upgrading insulation, or replacing old windows with energy-efficient models. By offering favorable terms, green loans help homeowners make their properties more energy-efficient and environmentally friendly.

Benefits of green loans include:

- Lower interest rates compared to traditional loans

- Potential tax incentives and rebates

- Enhanced property value due to energy-efficient upgrades

For more details on the benefits of green loans, check out Energy.gov’s guide and NABERS.

Types of Green Loans Available

There are various types of green loans, each designed to suit different needs:

- Loans for solar panels: Specifically for installing solar energy systems

- Green home improvement loans: For broader energy-efficient upgrades, like insulation or new windows

Understanding the different types will help you choose the most suitable option for your project.

2. Eligibility Criteria for Green Loans

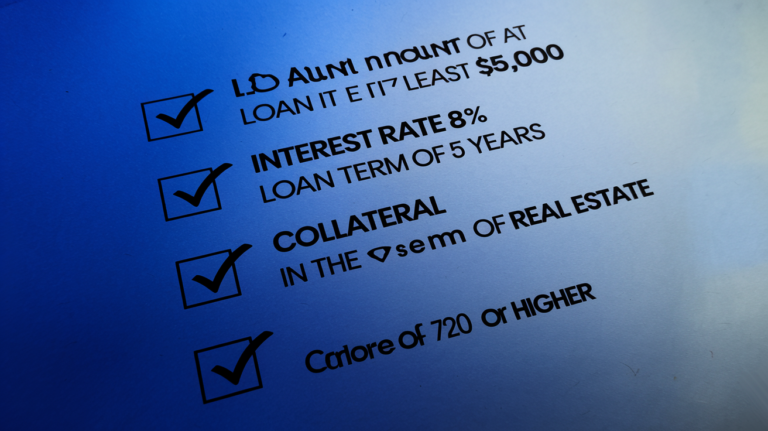

Credit Score Requirements

To qualify for green loans, your credit score is a crucial factor. Lenders typically require a good to excellent credit score, which demonstrates your reliability in repaying debts. A higher credit score can also help you secure better loan terms and lower interest rates.

Improving your credit score can involve paying off existing debts, ensuring timely payments on current loans, and correcting any errors in your credit report.

For more information on credit score requirements, visit Experian’s credit score guide.

Income and Employment Verification

Lenders require proof of stable income and employment to ensure you can afford the loan repayments. This might involve providing recent pay stubs, tax returns, or employment letters. Stable income reassures lenders of your ability to handle the loan.

If you’re self-employed or have irregular income, you may need to show additional documentation or provide a higher down payment.

Debt-to-Income Ratio

Your debt-to-income (DTI) ratio is another critical factor in qualifying for green loans. This ratio compares your monthly debt payments to your gross monthly income. Lenders use it to assess your ability to manage additional debt.

A lower DTI ratio generally indicates better financial health and a higher likelihood of loan approval. Most lenders prefer a DTI ratio below 40%.

For a detailed explanation of DTI ratios, refer to NerdWallet’s guide.

3. Property Requirements for Green Loans

Home Energy Efficiency Rating

Lenders often require a home energy efficiency rating or an energy audit before approving green loans. This rating assesses how effectively your home uses energy and identifies areas for improvement.

An energy-efficient home typically qualifies for better loan terms. Home energy audits can help pinpoint specific upgrades needed to enhance efficiency.

Check the U.S. Department of Energy’s audit guide for more details.

Type and Condition of Property

The type and condition of your property play a significant role in qualifying for green loans. Generally, your home must be in good condition, and some lenders may have restrictions on the types of properties eligible for green financing.

Investment properties or properties in need of major repairs might not qualify for certain green loans. Ensure your home meets the lender’s criteria before applying.

4. Documentation and Application Process

Required Documentation

When applying for green loans, you need to provide various documents, including:

- Proof of identity (e.g., driver’s license, passport)

- Proof of income (e.g., pay stubs, tax returns)

- Proof of homeownership (e.g., mortgage statements, property deed)

- Energy audit report (if required)

Having these documents ready can expedite the application process and improve your chances of approval.

Application Procedure

The application process for green loans typically involves:

- Submitting an application with your personal and financial details

- Providing required documentation as outlined by the lender

- Undergoing a credit check and assessment of your financial situation

- Awaiting loan approval and signing the loan agreement

Each lender may have specific requirements or additional steps, so it’s essential to follow their guidelines carefully.

For a comprehensive overview of the application process, visit LendingTree’s guide.

5. Additional Considerations

Loan Terms and Conditions

Understanding the terms and conditions of your green loan is crucial. This includes the interest rate, repayment period, and any associated fees. Some loans may have specific requirements or restrictions on how the funds are used.

Compare different loan options to find the best terms that fit your needs and financial situation.

Impact on Property Value

Upgrading your home with energy-efficient improvements can increase its value. Many green loans not only help finance these upgrades but also offer potential increases in property value, which can be advantageous if you decide to sell your home in the future.

Consult with a real estate professional to understand how specific improvements might impact your property’s market value.

Conclusion

Qualifying for green loans involves meeting specific criteria related to your financial health, property condition, and the type of improvements you plan to make. By understanding these requirements and preparing accordingly, you can increase your chances of securing a green loan for your solar panels or other energy-efficient upgrades.

To learn more about loans for solar panels and green home improvement loans, refer to reputable sources such as Energy.gov, NABERS, and NerdWallet.