Understanding the Depreciation of Solar Panels for Businesses

Solar panels are increasingly becoming a popular investment for businesses looking to cut energy costs and enhance their sustainability efforts. However, understanding how solar panels depreciate over time is crucial for businesses to make informed financial decisions. This article explores the factors influencing the depreciation of solar panels and how businesses can benefit from loans for solar panels and green home improvement loans to maximize their investment.

What is the Depreciation of Solar Panels?

Depreciation refers to the reduction in the value of an asset over time. For solar panels, this typically involves a gradual decrease in their efficiency and value as they age.

How Solar Panels Depreciate Over Time

Solar panels depreciate due to wear and tear, exposure to the elements, and technological advancements. Generally, solar panels have a useful life of about 25 to 30 years. Over this period, their efficiency decreases, leading to a reduction in their overall value.

Factors Influencing Solar Panel Depreciation

Several factors affect the rate at which solar panels depreciate. These include the quality of the panels, the local climate, and the maintenance practices employed. Panels installed in harsh climates or with lower-quality components may depreciate faster than those in more favorable conditions.

Impact of Depreciation on Business Financials

Understanding the depreciation of solar panels helps businesses plan their finances better. Depreciation affects the residual value of the panels and can impact financial statements and tax benefits.

Financial Statements and Depreciation

Businesses need to account for solar panel depreciation in their financial statements. Depreciation affects the asset’s book value, which impacts the company’s overall financial health. Regularly updating these values ensures accurate reporting and financial forecasting.

Tax Implications of Solar Panel Depreciation

The depreciation of solar panels can also influence tax deductions. Businesses can benefit from accelerated depreciation methods, such as the Modified Accelerated Cost Recovery System (MACRS) in the U.S. This approach allows for larger deductions in the earlier years of the panel’s life. For more details on MACRS, you can refer to the IRS guidelines.

Maximizing Investment with Loans for Solar Panels

To counteract the initial cost of installing solar panels, businesses often turn to loans for solar panels. These financial products can help businesses afford the upfront investment and manage the impact of depreciation over time.

Types of Loans for Solar Panels

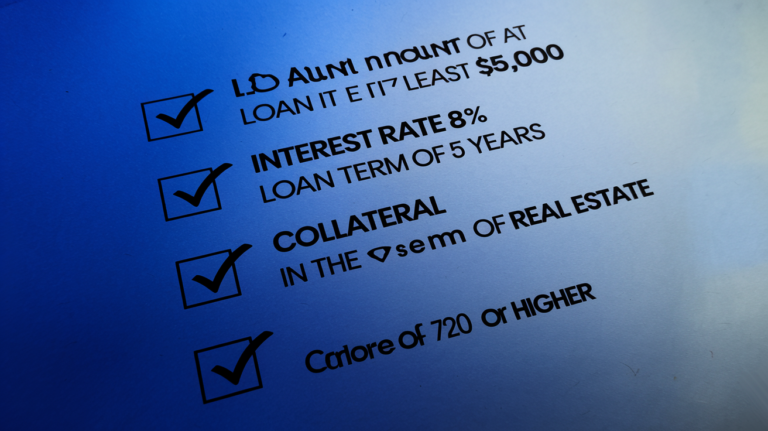

Loans for solar panels come in various forms, including secured loans, unsecured loans, and lines of credit. Each type has its benefits and considerations. Secured loans may offer lower interest rates but require collateral, while unsecured loans generally have higher rates but no collateral requirements.

Benefits of Using Loans for Solar Panels

Using loans for solar panels can provide several advantages:

- Lower upfront costs: Loans help businesses avoid significant initial expenses.

- Tax benefits: Interest payments on some loans may be tax-deductible.

- Improved cash flow: Loans can spread the cost over time, preserving working capital.

For more information on financing options, check out this guide from the U.S. Department of Energy.

Green Home Improvement Loans and Their Role

Green home improvement loans are another financing option that businesses can explore. These loans are specifically designed to fund energy-efficient upgrades, including solar panel installations.

Features of Green Home Improvement Loans

Green home improvement loans offer several features that can be advantageous for businesses:

- Lower interest rates: These loans often come with reduced interest rates compared to traditional loans.

- Flexible terms: Repayment terms are typically more flexible, making it easier for businesses to manage their budgets.

- Incentives: Some loans include additional incentives, such as rebates or grants.

How Green Home Improvement Loans Support Solar Panel Investments

By using green home improvement loans, businesses can:

- Offset installation costs: The loans help cover the initial costs of solar panels, reducing the financial burden.

- Enhance sustainability: Financing options encourage more businesses to invest in green technologies, contributing to broader sustainability goals.

To explore green home improvement loan options, refer to this resource from the Environmental Protection Agency.

Practical Steps for Managing Solar Panel Depreciation

Effective management of solar panel depreciation involves regular maintenance and strategic financial planning.

Regular Maintenance

Routine maintenance can slow the rate of depreciation by ensuring that solar panels operate efficiently for as long as possible. This includes cleaning the panels, inspecting for damage, and addressing any issues promptly.

Financial Planning and Depreciation

Businesses should incorporate depreciation into their financial planning to manage its impact effectively. This involves forecasting depreciation expenses and understanding how they affect overall financial projections.

Conclusion

Understanding the depreciation of solar panels is essential for businesses looking to make a smart investment in solar energy. By leveraging loans for solar panels and green home improvement loans, businesses can manage the financial aspects of their investment and maximize long-term benefits. Regular maintenance and strategic financial planning further enhance the value derived from solar panel installations.

For more information, refer to these resources:

- IRS Guidelines on MACRS

- U.S. Department of Energy Financing Guide

- EPA Green Home Improvement Financing