Updates on Government-Backed Green Financing Programs

Government-backed green financing programs are evolving rapidly to support eco-friendly initiatives. As these programs continue to adapt, it’s crucial for homeowners and investors to stay informed about the latest updates. In this article, we’ll explore recent developments in green financing, focusing on loans for solar panels and green home improvement loans.

The Evolution of Government-Backed Green Financing Programs

Increased Funding for Green Home Improvement Loans

In recent years, governments have significantly increased funding for green home improvement loans. This boost in funding aims to make eco-friendly renovations more accessible to a broader audience. By offering more substantial financial support, these programs encourage homeowners to invest in energy-efficient upgrades, thereby reducing their environmental footprint.

Government-backed loans often come with favorable terms, such as lower interest rates and extended repayment periods. For example, the U.S. Department of Energy’s Home Energy Renovation Opportunity (HERO) program has been expanded to include a wider range of green improvements, from solar panels to high-efficiency HVAC systems (source).

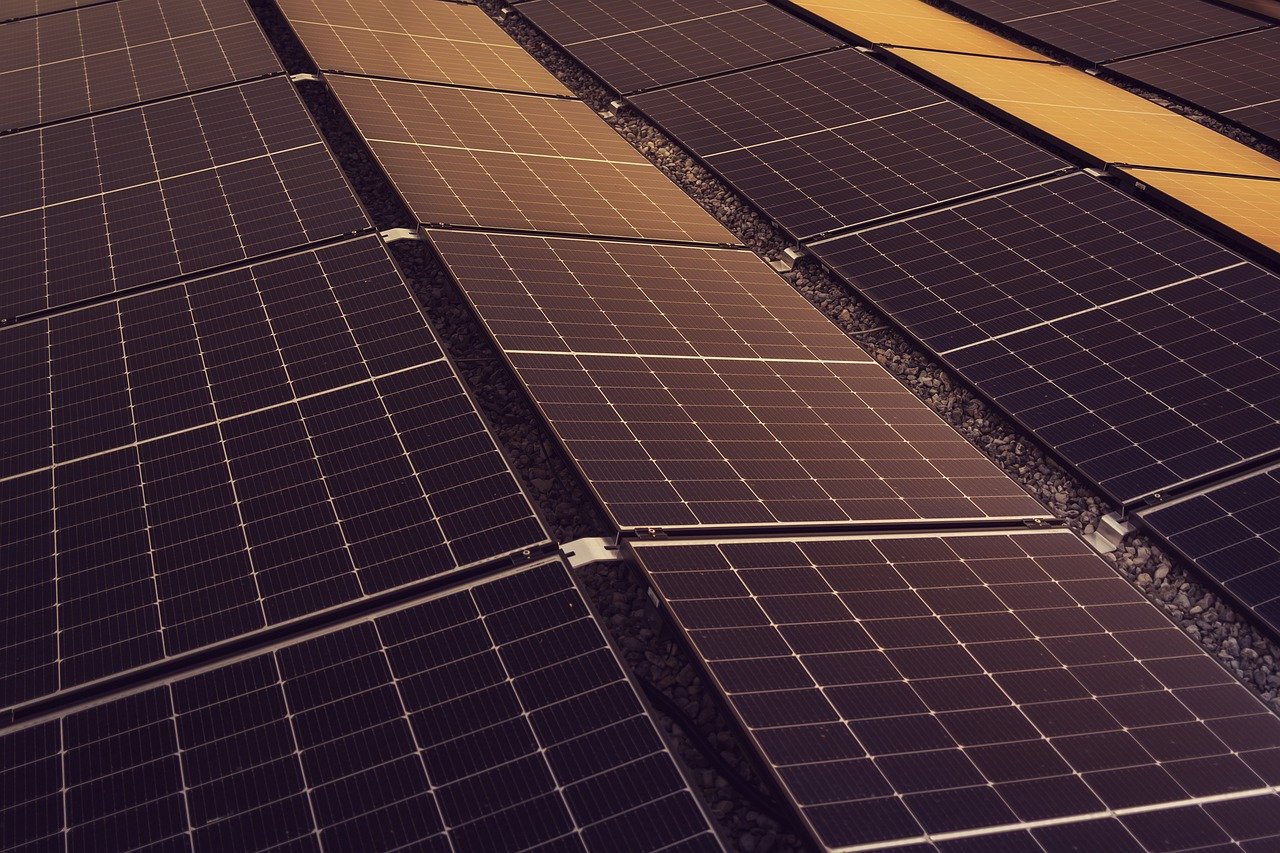

Enhanced Incentives for Solar Panel Installations

Loans for solar panels have become a significant focus in recent green financing updates. Governments are now offering enhanced incentives to make solar energy more accessible. This includes increased subsidies and tax credits for solar panel installations. Such incentives aim to reduce the upfront costs associated with solar technology, making it a viable option for more homeowners.

In the U.S., the Solar Investment Tax Credit (ITC) provides a 26% federal tax credit for solar panel installations, which will gradually decrease in the coming years (source). Additionally, various state programs offer additional rebates and incentives, contributing to lower overall costs.

New Program Initiatives for Eco-Friendly Renovations

Introduction of Zero-Interest Loans

A notable development in green financing is the introduction of zero-interest loans for energy-efficient home improvements. These loans aim to eliminate the barrier of high-interest rates, making it easier for homeowners to undertake green renovations. By removing interest charges, these programs help ensure that the savings on energy bills outweigh the costs of the loan.

For example, the UK’s Green Home Finance Innovation Fund includes provisions for zero-interest loans targeted at low-income households (source). Such initiatives are designed to promote widespread adoption of energy-saving technologies and encourage more sustainable living practices.

Expansion of Loan Eligibility Criteria

Recent updates have also expanded the eligibility criteria for green home improvement loans. Previously, many of these programs had stringent requirements, limiting access to only those who could meet specific financial criteria. However, new policies have broadened these criteria to include a more diverse range of applicants.

For instance, in Canada, the Canada Greener Homes Loan program now allows homeowners with varying credit scores to apply for loans, as long as they meet basic income requirements (source). This expansion aims to make green financing more inclusive and accessible to a wider audience.

The Impact of Recent Policy Changes on Homeowners

Financial Benefits of Updated Green Financing Programs

The recent updates to green financing programs have provided substantial financial benefits to homeowners. Lower interest rates, zero-interest loans, and expanded eligibility criteria have all contributed to making eco-friendly home improvements more affordable. These financial benefits enable homeowners to invest in energy-saving technologies without bearing a heavy financial burden.

Moreover, these updates often come with additional perks, such as rebates and tax credits, further reducing the overall cost of green renovations. For example, energy-efficient upgrades may qualify for tax credits, leading to even greater savings (source).

Long-Term Savings from Energy-Efficient Upgrades

Investing in loans for solar panels and other energy-efficient home improvements can result in significant long-term savings. Reduced energy bills are one of the most notable benefits, as homes equipped with solar panels or energy-efficient systems consume less energy from the grid. Over time, these savings can offset the initial costs of the upgrades and improve overall financial stability.

Additionally, energy-efficient homes often have higher property values, making them a worthwhile investment. As more buyers seek out sustainable living options, homes with green upgrades may command higher prices on the market.

Future Outlook for Green Financing Programs

Anticipated Changes in Government Policies

Looking ahead, further changes in government policies regarding green financing are expected. As climate change continues to be a pressing global issue, governments are likely to introduce more robust incentives and funding opportunities for green home improvements. These changes may include increased financial support, expanded loan options, and additional tax benefits.

For example, upcoming legislation in the EU proposes even greater subsidies for energy-efficient home renovations, reflecting a growing commitment to environmental sustainability (source). Homeowners should stay informed about these developments to take advantage of new opportunities as they arise.

The Role of Technology in Green Financing

Technology will play a crucial role in the future of green financing. Innovations in energy-efficient technologies and smart home systems are expected to drive further advancements in green financing programs. For instance, improvements in solar panel efficiency and smart thermostats could lead to new financing options tailored to these technologies.

As technology continues to evolve, green financing programs will likely adapt to include the latest advancements, offering even more opportunities for homeowners to invest in sustainable living.

Conclusion

Government-backed green financing programs are continually evolving to support eco-friendly home improvements. With increased funding, enhanced incentives, and expanded eligibility criteria, these programs are making it easier for homeowners to invest in energy-efficient upgrades. As we look to the future, continued advancements in policy and technology will likely drive further improvements in green financing, making sustainable living more accessible and affordable for everyone.